FIN/S

Asset Management Services

FIN/S

Αξιοποιήστε την πιο εξελιγμένη τεχνολογία και το πλέον σύγχρονο λογισμικό για να παρέχετε βέλτιστες υπηρεσίες στην κοινότητα της διαχείρισης επενδύσεων. Η λύση FIN/S για Διαχείριση Assets περιλαμβάνει μια προηγμένη ενότητα διαχείρισης κινδύνου για τη μέτρηση των πιο κοινών δεικτών ρίσκου σε συνδυασμό με λειτουργίες Ανάλυσης Χαρτοφυλακίου όπως η Συνεισφορά και η Αναφορά Απόδοσης, καθώς και με Λύσεις για οποιεσδήποτε ανάγκες Front και Back Office.

FRONT OFFICE

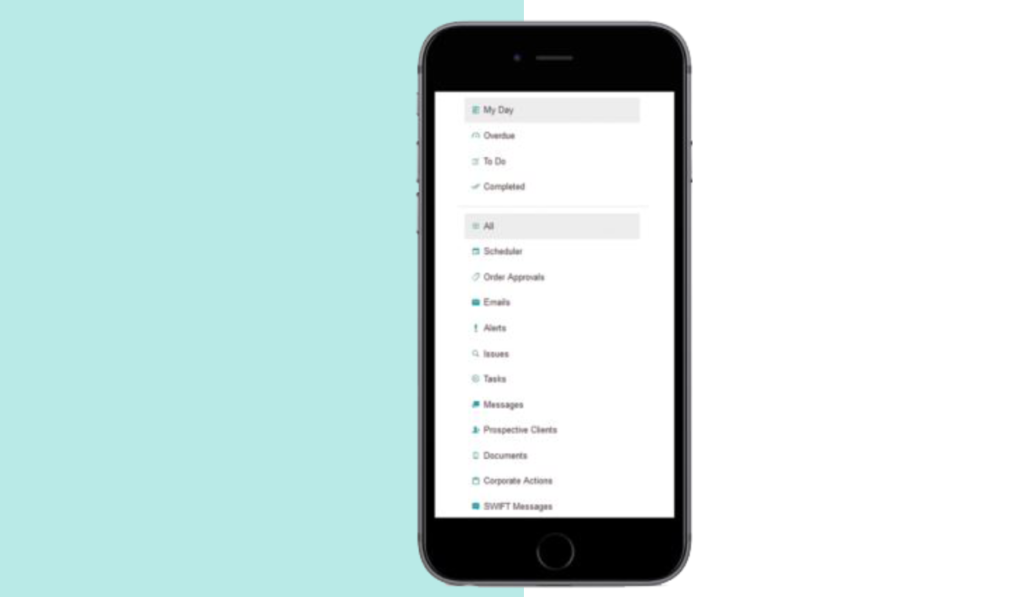

TO-DO

TO-DO

Μέσω της “Oθόνης Yποδοχής” το FIN/S προσφέρει μια φιλική, ενοποιημένη επισκόπηση των καθημερινών εργασιών, ειδοποιήσεων ή επερχόμενων events. Παράλληλα, μέσω του χρονοδιαγράμματος “My Day” οργανώνει τις καθημερινές εργασίες του προσωπικού ώστε να είναι σε θέση να αυξάνουν την παραγωγικότητα και να παρέχουν υπηρεσίες υψηλής ποιότητας στους πελάτες τους.

Μάθε Περισσότερα

CRM

CRM

Η Διαχείριση Πελατών συμμορφώνεται πλήρως με τις οδηγίες MiFID II & GDPR, προσφέροντας ασφάλεια στον Σύμβουλο Επενδύσεων. Κάθε πελάτης μπορεί να έχει στην κατοχή του πολλαπλά χαρτοφυλάκια -είτε μόνος είτε μαζί με άλλους επενδυτές- μέσω πολλαπλών συμβάσεων.

Τα προσωπικά δεδομένα, τα στοιχεία επικοινωνίας, οι επενδυτικές οδηγίες, οι κατηγορίες που ορίζονται από τον χρήστη και η πολιτική τιμολόγησης είναι άμεσα διαθέσιμα.

Μάθε Περισσότερα

Αναλύσεις και Αναφορές

Αναλύσεις και Αναφορές

Οι Πίνακες Ελέγχου (Dashboards) του FIN/S παρέχουν όλες τις απαραίτητες πληροφορίες σχετικά με τους υπό διαχείριση πελάτες, με έναν σύγχρονο και φιλικό τρόπο. Τα δεδομένα σχεδιάζονται και παρουσιάζονται σε πολλαπλούς εύχρηστους πίνακες, διαγράμματα πίτας, ιστογράμματα ή μετρητές, προσφέροντας μια συνολική εικόνα των πελατών και των επενδυτικών μέσων. Επιπλέον, οι Βασικοί Δείκτες Απόδοσης (KPIs) προσφέρουν σημαντικές στατιστικές απεικονίσεις.

Μάθε Περισσότερα

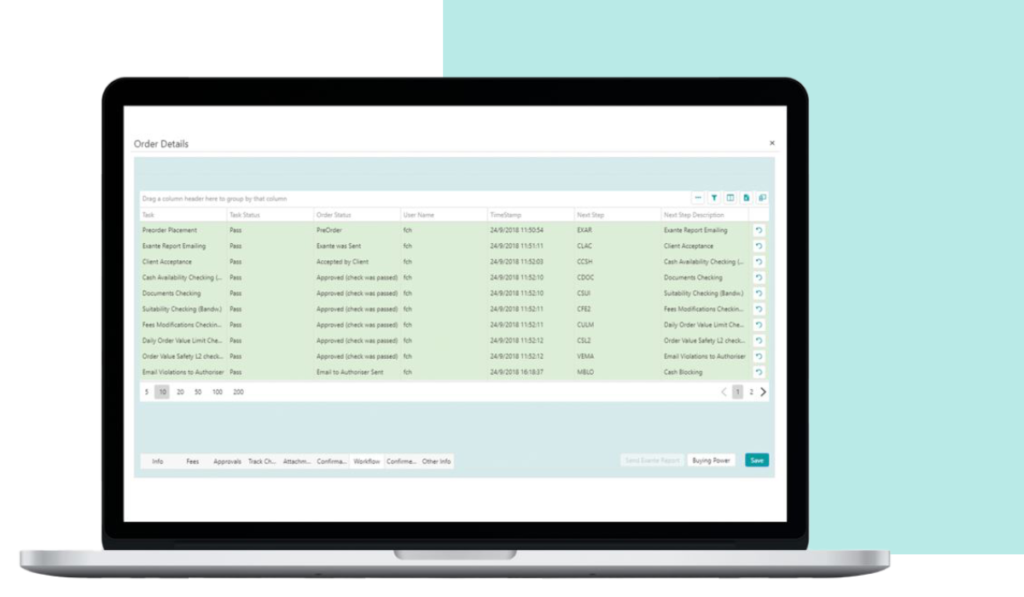

Διαχείριση Εντολών

Διαχείριση Εντολών

Το σύστημα διαχείρισης του FIN/S απλοποιεί τους κύκλους ζωής των εντολών, από τη συμπλήρωση έως την εκτέλεση και την πληρωμή τους, με άμεσες διαδικασίες και προσαρμόσιμες ροές εργασιών. Το σύστημα είναι σχεδιασμένο με απλό και αποτελεσματικό τρόπο, καλύπτοντας ταυτόχρονα ένα ευρύ φάσμα επενδυτικών μέσων, πολιτικές τιμολόγησης πελατών, σχέσεις multi-broker και ανάγκες πολλαπλών νομισμάτων.

Μάθε Περισσότερα

MIDDLE OFFICE

Διαχείριση Κινδύνου

Διαχείριση Κινδύνου

To FIN/S περιλαμβάνει ένα ενσωματωμένο σύστημα διαχείρισης κινδύνων, το οποίο περιλαμβάνει ειδικούς αλγόριθμους για τον υπολογισμό της Αξίας σε Κίνδυνο (Value at Risk – VaR). Το σύστημα διασφαλίζει μια ενδεδειγμένη, τεκμηριωμένη και τακτικά ανανεώσιμη διαδικασία σύμφωνα με τους επιχειρησιακούς στόχους, την επενδυτική στρατηγική και τις ρυθμιστικές αρχές. Με αυτόν τον τρόπο, το εταιρικό προσωπικό έχει τη δυνατότητα προσδιορισμού, υπολογισμού και ελέγχου όλων των κινδύνων που σχετίζονται με κάθε επενδυτική στρατηγική.

Μάθε Περισσότερα

Στρατηγικές Επενδύσεων

Στρατηγικές Επενδύσεων

Το FIN/S έχει τη δυνατότητα να καταγράφει τις επενδυτικές προτάσεις για κάθε Οργανισμό, οι οποίες ταξινομούνται βάσει κατηγοριών πελατών, περιλαμβάνοντας τα χρηματοοικονομικά προϊόντα, την ενέργεια που πρέπει να πραγματοποιηθεί, την αξία του χαρτοφυλακίου, τους παράγοντες κινδύνου, την ενημέρωση του πελάτη, τον δημιουργό της πρότασης κ.ά.

Μάθε Περισσότερα

BACK OFFICE

![]()

Post Trade

-

Επεξεργασία και Ιστορικό Συναλλαγών

-

Σύνθετους υπολογισμούς Προμηθειών & Αμοιβών

-

Λογαριασμό και Διαχείριση Μετρητών

-

Υπολογισμούς Περιοδικών Χρεώσεων

-

Αξιολόγηση Θέσεων και Δεδουλευμένων

-

Δείκτες και Σχεδιασμό Σημείων Αναφοράς

-

Λογιστική Εταιρικής Σχέσης

Μάθε Περισσότερα

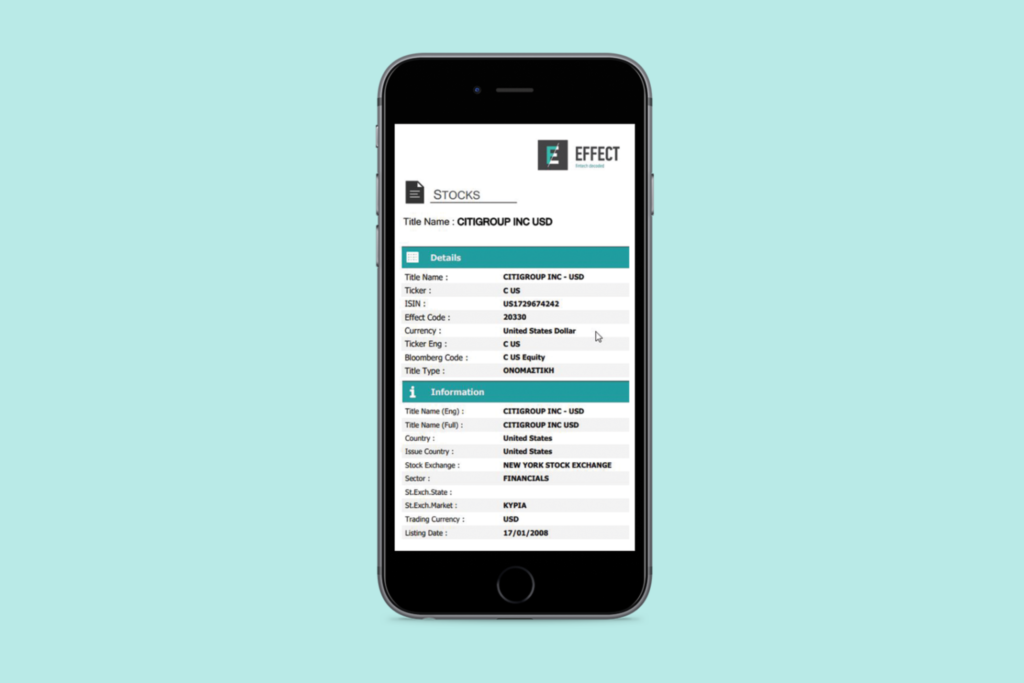

Διαχείριση Επενδυτικών Προϊόντων

Διαχείριση Επενδυτικών Προϊόντων

Στο παρόν τμήμα τηρούνται όλες οι λεπτομέρειες κάθε επενδυτικού μέσου. Μέσω της Διαχείρισης Επενδυτικών Προϊόντων, ο Οργανισμός παρακολουθεί κάθε είδους επενδυτικά προϊόντα που μπορεί να περιλαμβάνονται σε ένα Χαρτοφυλάκιο.

Παρέχονται περίοδοι πληρωμής κουπονιών για ομόλογα και άλλα παρόμοια προϊόντα, ενώ όλες οι πληροφορίες για οποιαδήποτε εταιρική πράξη διατηρούνται σε καθορισμένες, ευέλικτες μορφές.

Μάθε Περισσότερα

Εταιρικές πράξεις

Εταιρικές πράξεις

Το FIN/S αυτοματοποιεί πλήρως τις σύνθετες εργασίες που αφορούν εταιρικές πράξεις, αντιμετωπίζοντας τις με έναν ομοιόμορφο και εξαιρετικά απλό και φιλικό προς το χρήστη τρόπο. Όλες οι εταιρικές πράξεις για όλους τους τύπους προϊόντων αντιμετωπίζονται με την ίδια διαδικασία, η οποία διασφαλίζει τον πλήρη έλεγχο και εξαλείφει τις πιθανότητες σφαλμάτων.

Μάθε Περισσότερα

Έξοδα και Χρεώσεις

Έξοδα και Χρεώσεις

Η λειτουργία EFFECT Fees προσφέρει μια πλήρως

παραμετρική πλατφόρμα η οποία εφαρμόζει

υπολογισμούς οποιουδήποτε είδους σε

οποιοδήποτε νόμισμα για τη διαχείριση των

εξόδων , των φόρων, και άλλων χρεώσεων.

Αντίστοιχα, υπολογίζει τα περιοδικά έξοδα (Έξοδα

επιτήρησης, διαχείρισης και απόδοσης) βάσει της

συγκεκριμένης συμφωνίας κάθε πελάτη,

δημιουργεί αυτόματα συναλλαγές χρέωσης για

κάθε χαρτοφυλάκιο και εκδίδει τιμολόγια.

Μάθε Περισσότερα

Περιοδικές Αναφορές

Περιοδικές Αναφορές

Το σύστημα μπορεί να παρέχει κάθε είδους δήλωση

για ενεργά Χαρτοφυλάκια. Το οριζόμενο Νόμισμα

Αναφοράς χρησιμοποιείται ανά Χαρτοφυλάκιο

ή/και ανά Πελάτη. Όλες οι λεπτομέρειες σχετικά με

τη συχνότητα και τα μέσα αποστολής της δήλωσης

καθορίζονται στο σύστημα ανά Χαρτοφυλάκιο.

Όλες οι δηλώσεις μπορούν εύκολα να

μεταφραστούν σε οποιαδήποτε γλώσσα απαιτηθεί.

Μάθε Περισσότερα

SWIFT engine

SWIFT engine

Ο μηχανισμός SWIFT του συστήματος είναι εξαιρετικά παραμετρικός και έχει σχεδιαστεί έτσι ώστε να υποστηρίζει όλα τα μηνύματα SWIFT MT5. Με τον τρόπο αυτό μπορεί να αναγνωρίζει και να παράγει διαφορετικά μηνύματα που καλύπτουν τη ροή εργασιών του Οργανισμού.

Μάθε Περισσότερα

Λογιστική

Λογιστική

Το EFFECT FIN/S παρέχει μια ολοκληρωμένη, ενσωματωμένη ενότητα λογιστικής, με πλήρεις λειτουργίες που βοηθούν τις εταιρείες να βελτιστοποιήσουν τις επιχειρηματικές τους δραστηριότητες και να επιταχύνουν την εκτέλεση των απαιτούμενων εργασιών. Μέσα από ασφαλείς και αξιόπιστες διαδικασίες, οι οργανισμοί μπορούν να διατηρούν ένα ευρύ φάσμα από λογιστικές εγγραφές, σε μια ενιαία βάση δεδομένων.

Μάθε Περισσότερα

MANAGEMENT

Βασικοί Δείκτες Απόδοσης (KPIs)

Βασικοί Δείκτες Απόδοσης (KPIs)

Το FIN/S προσφέρει πλήθος δεικτών KPI (Key Performance Indicators) που βοηθούν τις εταιρείες διαχείρισης επενδύσεων να παρακολουθούν τις επιχειρηματικές τους μετρήσεις αναφορικά με τις αποδόσεις πελατών και επενδύσεων, διατηρώντας παράλληλα μια σαφή εικόνα ως προς την αποτελεσματικότητα κάθε εταιρείας. Μέσα από προηγμένους πίνακες ελέγχου και αναλυτικές αναφορές, οι διαχειριστές μπορούν να αναθεωρούν τους δείκτες Απόδοσης (KPIs)ανάλογα με τους επιχειρηματικούς τους στόχους.

Μάθε Περισσότερα

AUDITING & COMPLIANCE

Καταγραφή αλλαγών

Καταγραφή αλλαγών

Όλες οι εκτελεσθείσες συναλλαγές και ενέργειες καταγράφονται στο σύστημα και είναι διαθέσιμες στον υπεύθυνο ασφαλείας. Σε κάθε περίπτωση καταγράφεται η ημερομηνία και η ώρα της συναλλαγής, καθώς και ο χρήστης και ο υπολογιστής που έχει εκτελέσει τη συναλλαγή. Εάν η ενέργεια είναι τροποποιητική,καταγράφονται τα στοιχεία της συναλλαγής πριν και μετά τη μεταβολή. Οι αλλαγές που καταγράφονται δεν μπορούν να τροποποιηθούν με κανέναν τρόπο από οποιονδήποτε χρήστη.

Μάθε Περισσότερα

Ειδοποιήσεις και αποστολή μηνυμάτων

ηλεκτρονικού ταχυδρομείου

Το υποσύστημα online ειδοποιήσεων του FIN/S λειτουργεί στο background της εφαρμογής πραγματοποιώντας ανάλυση σε πραγματικό χρόνο και δημιουργώντας ειδοποιήσεις και μηνύματα ηλεκτρονικού ταχυδρομείου σύμφωνα με παραμέτρους και στόχους που έχουν προκαθοριστεί.

Μάθε Περισσότερα

ADMINISTRATION

Σχεδιασμός workflow

Σχεδιασμός workflow

Το FIN/S περιλαμβάνει έναν ισχυρό μηχανισμό που εξομαλύνει όλες τις επιχειρηματικές διαδικασίες με εύχρηστες ροές εργασίας. Ο σχεδιασμός του παρέχει όλες τις βασικές λειτουργίες που χρειάζονται τα διευθυντικά και ανώτερα στελέχη των οργανισμών για ακόμα μεγαλύτερη αποτελεσματικότητα στις καθημερινές τους εργασίες, μειώνοντας παράλληλα τους κινδύνους σε επιχειρησιακό και κανονιστικό επίπεδο. Οι εξουσιοδοτημένοι χρήστες έχουν τη δυνατότητα να αντλούν όσες ροές εργασιών επιθυμούν, με απλή και απευθείας διαδικασία, χωρίς τεχνική παρέμβαση.

Μάθε Περισσότερα