CRM

Client Management is fully compliant with the directives MiFID II & GDPR, offering security to the investment advisor through the application of rules and procedures.

Each client may own multiple portfolios through multiple agreements. He may be either the sole owner of a portfolio or a joint holder.

All movements and communication are historically kept for each Client / Portfolio from the beginning of cooperation without adjustments and changes.

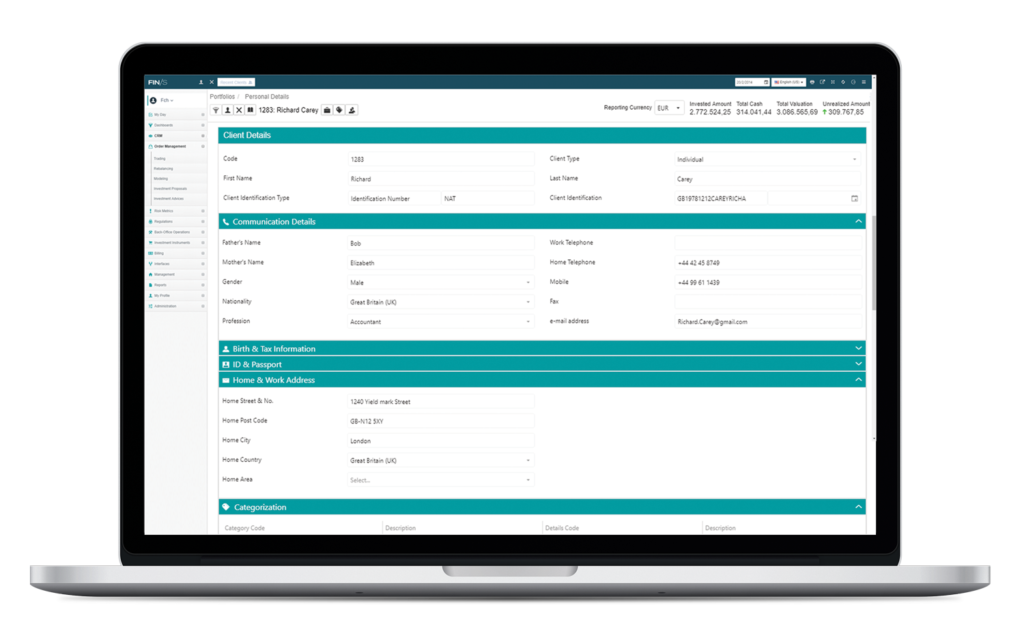

Having all client and portfolio information available in one screen, facilitates Relationship Managers and Advisors into tracking and monitoring anything they might need regarding their clients, in a user-friendly interface.

Personal data, communication details, investment instructions, user defined categories (e.g. Type of Service), pricing policy, are available at a glance:

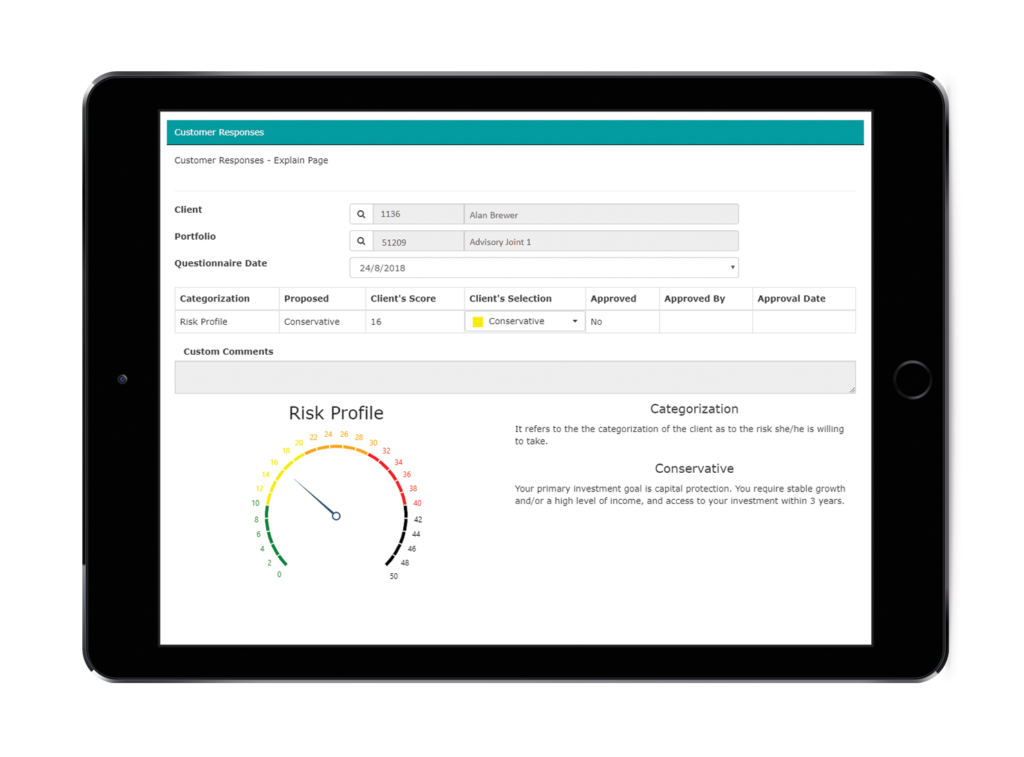

Investment profile (KYC / AML) and Categorization

A set of questionnaires can be designed according to the needs of the firm. With the internal advanced configurable algorithms for calculating the score, FIN/S automatically categorize clients and their portfolios.

Fee Schedule & Customize agreements per portfolio

FIN/S provides a flexible and automated fee processing platform that supports the transparent calculation and collection of any fee and commission type.

The daily needs and challenges regarding fees are consistently and accurately covered: transaction-level commissions and fees, commission breakdowns, periodic fees, daily accruals, over performance / high watermark fees, application of discount values or percentages. Different rules can be defined based on several parameters such as asset type, counterparty, currency.

FIN/S fee engine allows the application of rules regarding different and complex agreements with clients, counterparties and other stakeholders.

Officers aiming at setting the total fee policy for each portfolio, they can either select for each fee from a list of default agreements or apply different rules on predefined agreements, in a simple and user friendly structure.

In this way, officers can efficiently and easily define different policies per portfolio without having to create, manage and maintain global-level fee policies.

Communication Monitoring

FIN/S maintains a complete history of communication with the client, offering advanced emailing procedures to enable automated sending of documents such as Statements, Reports or Contract Notes. It can also be configured to send emails to be responded with default replies. And finally, FIN/S allows users to be synchronized with MS-Outlook in order to record any communication of customer concern made through outlook.

360 Investment Overview & History

In order to achieve clients’ and companies’ strategic goals, relationship managers and advisors need to have all necessary information gathered so as to facilitate their efforts, and to concentrate on portfolio management and on analyzing their options.

FIN/s Investment Overview provides everything that you might need for a 360ο overview of portfolios under management.

-

Investment Position allocation & analysis

-

Portfolio Performance & Benchmark analysis

-

Cash flow analysis and cash flow projections

-

Investment products per client analysis

-

Order placing or bulk ordering for a group of clients

-

“What If” scenarios

Drill down feature is available for investment positions or cash balances.

Portfolio and Reporting Consolidation

FIN/S covers different needs and requirements by offering high-level customization of the Overview. Different screens and layouts can be used not only per user or user group but also per investor or group of clients.

In browser’s header, user can find different tab per client, indicating client’s code, client’s name and portfolio code.