Investment Products Management

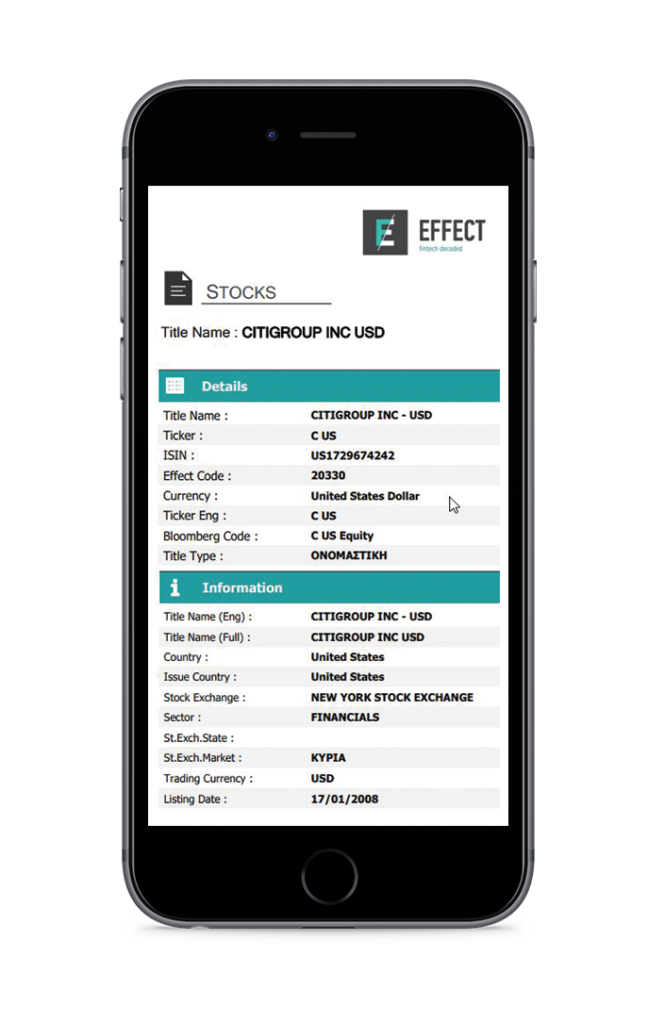

Through Investment Products Management, the organization monitors any type of investment products that may be included in a Portfolio.

All the details of any investment instrument are kept under this section. Coupon payment periods for bonds and other similar products are being set up, while all the information of any corporate action is kept in specific flexible forms. These details are used by FIN/S to update automatically any portfolio with the appropriate information.

Product categorization

Products can be categorized through user defined categories, providing a powerful tool for the implementation of investment strategies, as well as compliance validation for customers.

Comments and documents can be attached on each product card, providing the ability of keeping historic record of any information considered significant.

Pricing

Based on the pricing module of FIN/S, each Firm can specify one or multiple price sources, providing the ability to store multiple prices for the same product.

According to the Firm’s pricing policy, a primary price source (e.g. Bloomberg) is defined, but the Firm can also select to use a different source (e.g. Reuters) for specific portfolios and for a specific category of products (e.g. Bonds).

Data are updated and supported through feeds from external sources such as Bloomberg and Reuters. The import can occur in different ways, through a direct interface with the source or through an excel or a csv file.

The system also supports data quality strategies, such as reports for checking that all information retrieved from external market data providers and imported in the database are valid.

Through interfacing with world range data providers, such as Bloomberg, the following information can be obtained:

The interface with data providers worldwide, such as Bloomberg, may communicate information such as:

-

Product details, so that product cards are populated automatically

-

Corporate action details, according to daily announcements of the issuer

-

Daily prices