Order Management

Customizable Straight – through processing

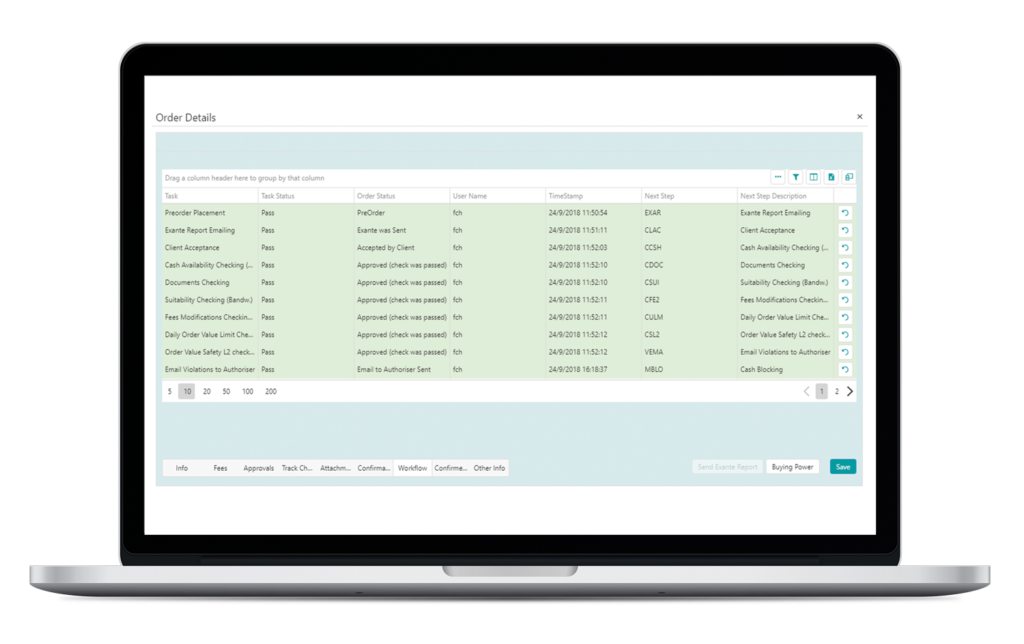

FIN/s order management system simplifies order life-cycles, from order placement to execution and settlement, based on Straight-through processes and customizable workflows. Different types of orders can be set according to service.

It is designed to be simple and efficient while covering a wide range of investment instruments, client pricing policies, multi-broker relationships and multi-currency needs.

Investment Policy & Guidelines

Managing the risk of selling products incompatible to client’s profile:

If any approvals are needed, notifications are sent automatically to Relationship Managers or Advisors in order to proceed with them. Approvals can be given or rejected through advisors’ mobile phone, tablet or a pc web browser.

Regulatory Compliance

Real-time compliance checks are executed for ensuring the orders’ compliance to regulations or other restrictions.

During order placement, online checks run regarding the pre-trade compliance: regulatory checks, investment restrictions, pre-defined limits, Client Documents, Cash Balance.

Regarding the online checks, approval requests are routed to authorized users (mobile device and FIN/S ‘My day’ screen) in order to proceed to the approval process. The order status is updated online, according to response.

If needed, FIN/S can automatically generate and send Suitability and / or Appropriateness test to the client.

Ex-Ante report

Fees and taxes are automatically updated. If needed, an ex-ante report can be automatically sent to client, who can accept or reject the order using his mobile phone, tablet or a pc web browser.

Automatic Execution Management & Multi broker Support

FIN/S supports an automated order routing to counterparties (FIX protocol). Additional interfaces with other order routing systems are available.

Portfolios Modeling & Rebalancing

Automated order creation through rebalancing (model management). FIN/S manages models through a sophisticated yet simplified system that customizes the title’s participation automatically. By using model baskets within portfolios, FIN/S reduces the number of models needed to be maintained by companies, offering effectiveness and flexibility to investors. Moreover, by deploying the powerful Markowitz investment tool, FIN/S contributes to the models’ optimization.

Multi portfolios Bulk Orders

After generating the orders for the selected clients, the system can group them by applying different criteria (e.g. per product, per type of order), so as to include those ‘bulk orders’ to a file (e.g. excel file format) that will be forwarded to the counterparties. After the execution of the Bulk Orders, the system provides the ability of allocating the transactions based on the initial grouping.

Orders can be forwarded to the counterparties through FIX protocol or other customized APIs.

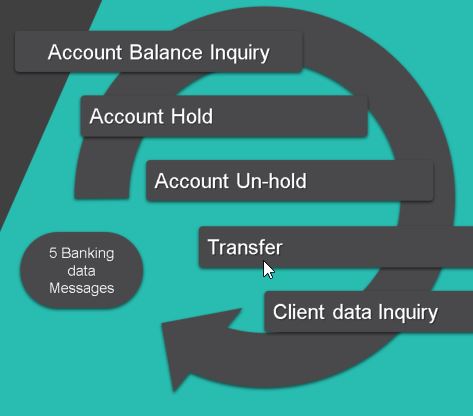

Interfaces with the core banking systems

FIN/S can also be connected to Core Banking System creating online blockings to client cash accounts, providing automations in all business units.